Did you know that people lost $10 billion to scams in 2023, according to the Federal Trade Commission’s (FTC) Consumer Sentinel Network Data Book? Of that, $2.7 billion came from imposter scams.1 These scammers exploit customer service teams to access sensitive information or accounts.

As a business, you’re in a position to stop fraud before it happens. Every interaction you have is an opportunity to detect red flags and protect both your business and your customers.

Recognize fraud risks during customer interactions and turn your help desk into a line of defense.

How Fraudsters Exploit Customer Service Interactions

Fraudsters know that customer service teams are focused on helping people quickly and solving problems. They take advantage of this kindness and pressure to dupe you into giving them what they want.

Below are some of their M.O. (modus operandi or mode of operating):

1. Pretending To Be A Customer

Fraudsters often act like frustrated or worried customers. They might claim they’ve lost access to their account or need urgent help. By creating a sense of urgency, they make you feel rushed, so you don’t double-check their information.

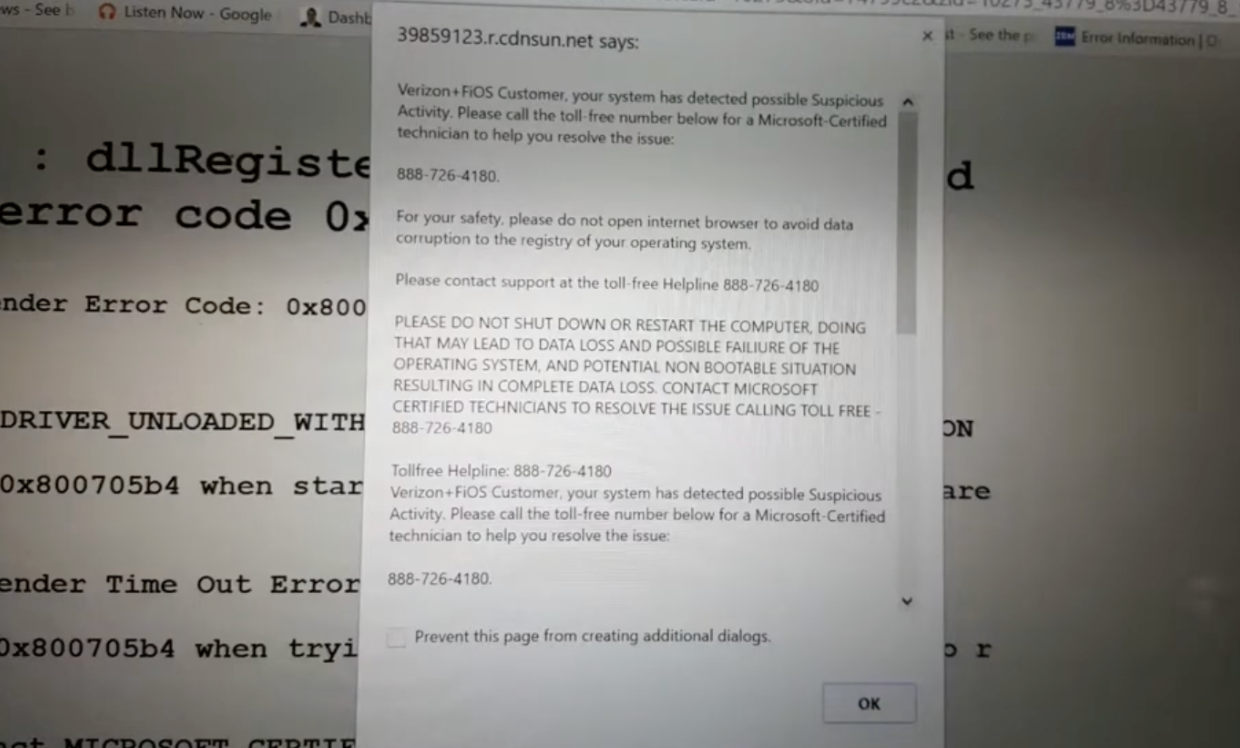

2. Asking For Sensitive Information

They might ask you to reset passwords, send account details, or provide personal information directly through phone or phishing emails. Fraudsters are skilled at sounding convincing, making you feel like their request is normal.

3. Using Social Engineering Attacks

Fraudsters are great at manipulating emotions. They might act angry to make you feel guilty, or overly friendly to build trust. These social engineering tactics are designed to lower your guard and get you to share confidential details.

4. Exploiting Your Processes

If your team has gaps in how it verifies customer identities, fraudsters will find them. For example, if you only ask for one piece of information to confirm identity, like a name or email, they’ll use stolen data to pass your checks.

5. Targeting Inexperienced Team Members

Fraudsters may try to mislead new or overwhelmed employees who might not know all the procedures yet. They count on these employees being too unsure to challenge suspicious requests.

So, take a moment to question anything that doesn’t feel right. It’s better to double-check than to let fraud slip through.

Identifying Red Flags During Customer Interactions

Fraudsters often try to hide their true intentions, but there are some warning signs you can watch out for:

1. Rushed Or Pushy Behavior

If someone is rushing you to take action or seems overly pushy, that’s a red flag. Fraudsters often create a sense of urgency to stop you from thinking carefully.

2. Inconsistent Information

Pay attention if the information a customer gives doesn’t match what’s in your records. For example, their name, email, or phone number might not match the account they’re asking about.

3. Bypassing Verification Steps

Be cautious if someone tries to skip security questions or gets upset when you ask for verification. A real customer usually understands why these steps are needed.

4. Asking For Questionable Actions

If a customer asks you to reset an account, change personal details, or send sensitive information without proper proof, it could be a sign of fraud.

5. Unusual Requests Or Claims

Watch out for customers who make strange or exaggerated claims, like saying their account has been hacked multiple times or insisting they need access immediately for an emergency.

6. Overly Detailed Stories

Sometimes, fraudsters provide too many unnecessary details to sound convincing. Real customers usually focus on the problem they need help with, not extra explanations.

7. Unusual Behavior In Communication

Look for things like using a tone that seems fake or overly emotional, typing errors or odd phrasing in messages, and calls coming from blocked or suspicious numbers.

Steps To Protect Your Business & Customers

What should you do when you discover these red flags? These are simple steps you can take to prevent them.

1. Verify Every Customer’s Identity

Always confirm who you’re talking to. Use security questions, account information, or other verification steps before making changes or giving out details. Don’t skip this step, even if someone seems in a hurry.

2. Train Your Team To Notice The Red Flags

Make sure everyone knows the signs of fraud, like inconsistent information or pushy behavior. Regular training keeps everyone alert and ready to handle suspicious situations.

3. Use Secure Systems

Rely on trusted security tools to protect sensitive data across all your devices. For example:

- Use encryption to keep information safe.

- Set up alerts for unusual activity in customer accounts.

4. Follow A Script For Suspicious Cases

Have clear steps for what to do if you suspect fraud. For example:

- Pause the interaction and ask for additional verification.

- Escalate the case to your fraud team or manager.

- Don’t make promises to the customer until everything is confirmed.

5. Communicate Clearly With Customers

If you detect fraud on an account, let the customer know right away. Explain what happened and how you’re fixing it. This builds trust and helps them feel protected.

6. Limit Access To Restricted Information

Only allow your team to see the details they need to do their job. The less access fraudsters can get, the safer everyone is.

7. Keep Your Processes Updated

Fraud methods change, so update your procedures regularly. Review what’s working, what’s not, and how you can stay ahead of new risks.

8. Report Fraud Quickly

If you confirm fraud, report it to your company’s fraud team or the proper authorities. This helps prevent further damage and protects other customers.

By following these steps, you make it harder for fraudsters to succeed. You also show your customers that you care about their safety, which builds loyalty and trust.

Leveraging AI & Automation To Analyze Customer Interactions

There’s a way to help you detect fraud and improve customer service at the same time, in real-time—by using Artificial Intelligence (AI) and automation.

These tools work fast and can handle large amounts of data, making your job easier and more secure. Here’s how you can use them:

1. Detect Suspicious Patterns

AI can analyze customer interactions and find unusual behavior. For example:

- A customer repeatedly trying to log in with different passwords

- Multiple accounts being accessed from the same location

These patterns might be too subtle for you to notice, but AI spots them instantly.

2. Automate Verification Steps

You can set up automated systems to verify customer identities, like sending a one-time code to their phone or email. This adds an extra layer of security and saves time for you and your team.

3. Flag High-Risk Interactions

AI can prioritize cases that seem risky. If an interaction has red flags—like a customer pushing for quick action or providing mismatched details—the system can alert you to take a closer look.

4. Improve Accuracy & Speed

Automation helps you handle repetitive tasks, like updating account details or resetting passwords. This reduces mistakes and frees up your time to focus on more complex customer needs.

5. Learn From Data

AI tools can analyze past interactions to improve fraud detection over time. For instance, they can determine new tactics fraudsters are using and help you stay ahead of them.

6. Enhance Customer Experience

While AI fights fraud, it also improves service. Automated tools can:

- Quickly answer common questions through chatbots

- Route customers to the right team faster

This keeps your real customers happy while keeping fraudsters out.

To get the most out of AI and automation, choose reliable tools designed for your business needs and train your team to use these tools effectively. AI and automation help you protect your business and customers without slowing down service. They make fraud detection smarter, faster, and more reliable, giving you peace of mind and a stronger defense.

FAQ

How Can I Identify Fraud Risks During Customer Interactions?

Look for red flags like customers rushing you, providing inconsistent information, or avoiding verification steps. If someone is asking for sensitive actions, like resetting an account without proper proof, that could also be a sign of fraud.

What Steps Should I Take If I Suspect Fraud During A Customer Interaction?

If you suspect fraud, pause the interaction, follow your company’s verification process, and escalate the case to your fraud team or manager. Don’t take any actions that could compromise security until everything is confirmed.

How Can AI & Automation Spot Fraud During Customer Interactions?

AI and automation can analyze customer interactions for unusual patterns, flag high-risk cases, and automate verification steps. These tools can double as your security measure to help you identify fraud faster and more accurately, improving both your security and customer service.

Source:

- Fair, L. (2024, February 9). Facts about fraud from the FTC – and what it means for your business. Federal Trade Commission. https://www.ftc.gov/business-guidance/blog/2024/02/facts-about-fraud-ftc-what-it-means-your-business